Answer the following question(s) using the information below:

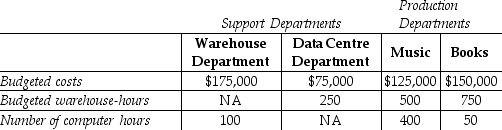

Betty's Book and Music Store has two service departments, Warehouse and Data Centre.Warehouse Department costs of $175,000 are allocated on the basis of budgeted warehouse-hours.Data Centre Department costs of $75,000 are allocated based on the number of computer log-on hours.The costs of operating departments Music and Books are $125,000 and $150,000, respectively.Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

-Using the direct method, what amount of Warehouse Department costs will be allocated to Department Books?

Definitions:

Federal Income Taxes

Taxes levied by the government on the income earned by individuals, corporations, trusts, and other legal entities.

Merit Rating

A system used to evaluate the performance of employees by systematically rating them on their abilities and achievements within the organization.

State Unemployment Taxes

Taxes paid by employers to fund the state unemployment compensation programs for laid-off workers.

Merit Rating

A system used to evaluate and grade an employee’s performance, often influencing salary increments and promotions.

Q5: Are relevant revenues and relevant costs the

Q7: In target costing, what are at least

Q17: What type of cost is the result

Q20: What is the STP sales-volume variance (contribution

Q76: The sales-volume variance plus or minus the

Q79: The productivity component of operating income focuses

Q94: Calculate the revenue allocation for Game A

Q110: Which of the following statements about productivity

Q130: Outsourcing is risk free to the manufacturer

Q147: Stone and Bicker are starting a new