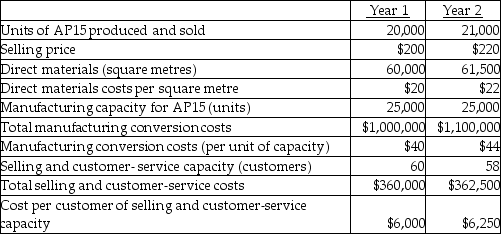

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Luke Company makes a high-end Appliance, AP15.Luke Company presents the following data for the years 1 and 2.  Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Luke Company has 46 customers in year 1 and 50 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Luke Company's net increase in operating income as a result of the price-recovery component?

Definitions:

Functionalism

A conceptual viewpoint in the fields of sociology and anthropology that explains every component of society by its role in maintaining the society's overall stability.

Symbolic Interactionism

A sociological perspective that examines how individuals and societies use symbols to communicate and create social realities.

Feminism

A socio-political movement aiming to achieve equality between genders, focusing on women's rights and interests.

Post-Structuralist

An approach in various academic disciplines that explores ways in which power, culture, and language intersect.

Q2: Research and development cost is an example

Q32: The cost function would be stated as<br>A)y

Q58: What is the Zorro Company sales-quantity variance?<br>A)$1,500

Q66: Which method of allocating costs would be

Q101: Value engineering is a time-and-motion system that

Q113: Fuel oil from petroleum processing

Q143: Companies periodically confront decisions about discontinuing or

Q156: Explain the differences between short-run pricing decisions

Q175: Munir Hassan, controller, gathered data on overhead

Q176: Lynn Valley Corporation currently manufactures a subassembly