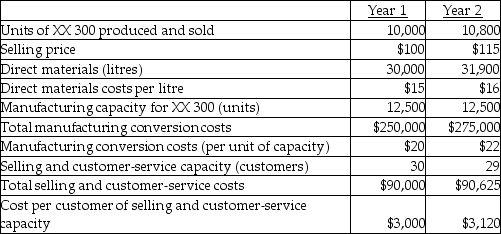

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Barry Company makes an XX 300.Barry Company presents the following data for the years 1 and 2.  Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-Referring to Barry Company, which of the following is a measure of the financial perspective?

Definitions:

Pre-acquisition

The phase before the acquisition of one company by another, during which due diligence, valuation, and negotiations occur.

Consolidation Adjustments

Adjustments made in the preparation of consolidated financial statements to eliminate intercompany transactions and balances among the parent and its subsidiaries.

Consolidated Financial Statements

Financial statements that aggregate the assets, liabilities, and operating results of a parent company and its subsidiaries, providing a complete financial view of the corporate group.

Shareholders

Individuals or entities that own shares in a corporation, making them owners of the company to the extent of the shares held.

Q3: Seneca Company has invested $1,000,000 in a

Q5: For the current year, Sally Anne Ltd.,

Q7: The Omega Corporation manufactures two types of

Q8: What is the N-C Associates' life-cycle budgeted

Q9: Harry's Electronics manufactures electronic parts.Data for two

Q24: For setting long-term prices a company should

Q33: All costs are relevant in short-run pricing

Q73: What is the Barry Company's net increase

Q97: The variation in total costs between two

Q118: If the sales value at splitoff method