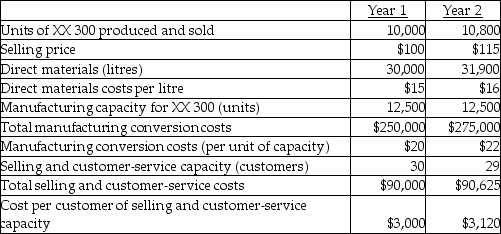

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Barry Company makes an XX 300.Barry Company presents the following data for the years 1 and 2.  Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Barry Company's revenue effect of price-recovery component?

Definitions:

Tax Levied

Refers to the imposition of taxes by a governing authority on individuals, corporations, or properties to generate revenue for public expenditures.

Quota

A government-imposed trade restriction that limits the number or monetary value of goods that can be imported or exported during a specific time frame.

Tariff

Tariff is a tax imposed by a government on goods and services imported from other countries to protect domestic industries or generate revenue.

Foreign-Produced Automobiles

Vehicles that are manufactured outside of a country's boundaries and then imported for sale within that country.

Q10: Anticipated future costs that differ with alternative

Q18: What are separable costs?

Q60: What is the estimated net realizable value

Q64: When a single manufacturing process yields two

Q65: If a dual-rate cost allocation method is

Q80: Target pricing includes: (1)developing a needed product,

Q99: What is the Merrill Company's revenue effect

Q120: Hunt Company and Indio Company are noncompeting

Q128: For the economic decision purpose<br>A)the costs in

Q135: For short-term pricing decisions, what costs are