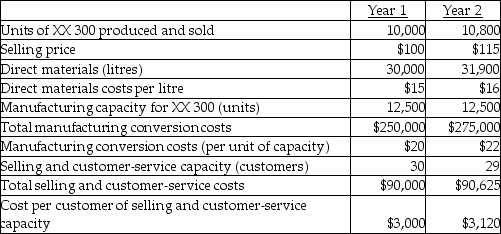

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Barry Company makes an XX 300.Barry Company presents the following data for the years 1 and 2.  Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Barry Company's productivity component of change in operating income?

Definitions:

Gluc/o

A word root used in the medical field to refer to sugar, particularly glucose, which is a primary source of energy for the body's cells.

Parathyroid Glands

Small endocrine glands located in the neck behind the thyroid, which regulate calcium levels in the blood and bone metabolism.

Thyroid Gland

An endocrine gland in the neck that produces hormones regulating the body's metabolic rate, heart and digestive function, muscle control, brain development, and bone maintenance.

Poison

A substance that is capable of causing illness or death when introduced into the body.

Q9: The single-rate cost allocation method provides better

Q43: Under cost-plus pricing, what is the required

Q50: Landmark Systems Inc.designs and manufactures global positioning

Q59: The life-cycle reporting process<br>A)is the same as

Q99: The Maintenance Department has been servicing Gizmo

Q105: What is the Satellite Inc.life cycle operating

Q106: If total invested capital is $1,000,000, what

Q152: The Product Data Center has been servicing

Q158: Time-series data analysis includes<br>A)using a variety of

Q164: Two entities, Burch Company and Carey Company,