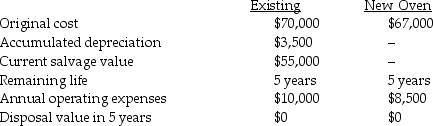

Sam, a bakery manager, replaced the convection oven just six months ago.Today, Commercial Ovens Manufacturing announced the availability of a new convection oven that cooks more quickly with lower operating expenses.Sam is considering the purchase of this faster, lower-operating cost convection oven to replace the existing one they recently purchased.Selected information about the two ovens is given below:

Required:

Required:

a.What costs are sunk?

b.What costs are relevant?

c.What are the net cash flows over the next 5 years assuming the bakery purchases the new convection oven?

d.What other items should Sam, as manager of the bakery, consider when making this decision?

Definitions:

Actuarial Value

A measure of the average amount of benefit a health insurance plan is expected to pay, used to compare different health insurance policies.

Actuary

A professional who analyzes financial risk using mathematics, statistics, and financial theory, mostly in the insurance and pension plan industries.

Expected Return

The anticipated amount of profit or loss an investment generates over a given period of time.

Defined Benefit Plan

A type of pension plan where the employer guarantees a specified pension payment upon retirement, based on the employee's earnings history, tenure of service, and age, rather than directly depending on individual investment returns.

Q15: The selection of the best measure of

Q33: If the budgeted cash disbursements for selling

Q41: Central Medical Supply Inc., a manufacturer of

Q63: The industrial-engineering method is<br>A)for analyzing relationships between

Q67: Including unit fixed costs for pricing is

Q78: Reverse engineering has the objective of reducing

Q87: When considering a project that will require

Q107: Line management exists to provide advice and

Q108: An organization that is using the product

Q152: The Product Data Center has been servicing