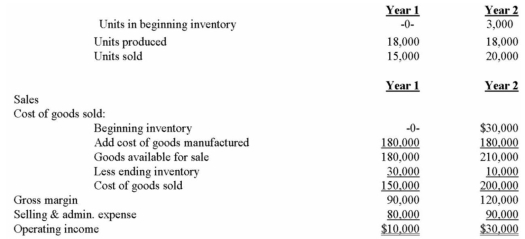

Operating data for Fowler Company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit.Fixed manufacturing overhead totals $72,000 in each year.This overhead is applied at the rate of $4 per unit.Variable selling and administrative expenses were $2 per unit sold.

Required:

a)What was the unit product cost in each year under variable costing?

b)Prepare new income statements for each year using variable costing.

c)Reconcile the absorption costing and variable costing operating income for each year.

Definitions:

Q5: At the beginning of the current year

Q27: What was the unit product cost under

Q28: The PDQ Company makes collections on credit

Q52: What was the operating income under absorption

Q75: In a budgeted income statement for the

Q87: The text identifies six ways to classify

Q103: Arranging for a shipment of a number

Q112: Setting up equipment is an example of

Q126: The Bhaskara Corporation used regression analysis to

Q166: The text identifies six ways to classify