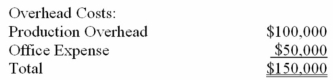

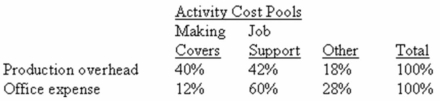

Phoenix Company makes custom covers for air conditioning units for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

Distribution of Resource Consumption:

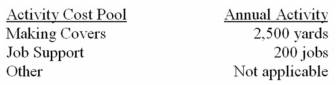

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.The amount of activity for the year is as follows:

Required:

a)Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

Definitions:

Contingent Payment

A payment that depends on achieving certain conditions or outcomes in the future.

Market Value

The current quoted price at which an asset or a company can be bought or sold on the open market.

Probability-Weighted

A method that takes into account the likelihood of various outcomes, often used in financial forecasting and risk assessment to estimate future cash flows or earnings.

Time Value

The concept in finance that money available at the present time is worth more than the same amount in the future due to its potential earning capacity.

Q29: At a break-even point of 800 units

Q37: In a normal job-order costing system,the use

Q44: The following data were taken from the

Q51: What was the carrying value on the

Q59: Sarver Company uses the weighted-average method in

Q74: Under variable costing,it may be possible to

Q75: What would be the total overhead cost

Q90: When a job is completed and transferred

Q102: Eve Company uses the weighted-average method in

Q119: A company with an income tax rate