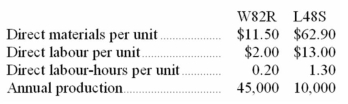

(Appendix 7A)Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,W82R and L48S,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labour-hours for the year is 22,000.

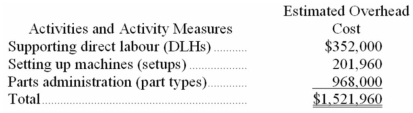

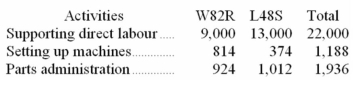

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Definitions:

Lessor

A lessor is the party that leases or rents a property or asset to another party, known as the lessee.

Capital Lease

A lease arrangement that is recorded as an asset on the lessee's balance sheet, essentially treated as a purchase of the leased asset for accounting purposes.

Transfer of Ownership

The act of passing the legal title of an asset from one entity or individual to another.

Q13: Dodero Company produces a single product that

Q26: Lee Company,which has only one product,has provided

Q30: Data concerning Sonderegger Company's operations last year

Q59: Jackson Painting paints the interiors and exteriors

Q65: What is the amount of fixed overhead

Q98: (Appendix 7A)The overhead cost per unit of

Q117: How much cost,in total,would be allocated in

Q118: According to the activity-based costing system,what was

Q306: What is the break-even point in sales

Q383: Which of the following is defined as