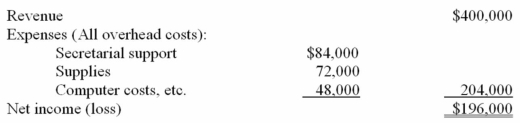

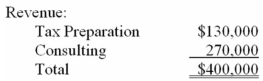

Mike Kyekyeku is a sole proprietorship that provides consulting and tax preparation services to its clients.Mike charges a fee of $100 per hour for each service and can devote a maximum of 4,000 hours annually to his clients.He reported the following revenues and expenses for 2014:

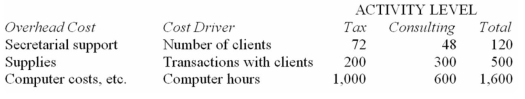

Being an accountant,Mike kept good records of the following data for 2014:

(i).

(ii).

Required:

a.Should Mike emphasize one service more than the other if Mike were to allocate all the overhead costs using direct-labours as the only overhead cost driver (1,300 for Tax and 2,700 for Consulting)? Support your decision with the relevant calculations and/or analysis.

b.Identify each of the three cost drivers as either unit-level,batch-level,product-level,customer-level,or organization-sustaining.

c.How might Mike's product/service emphasis decision in Part a above be altered if he were to allocate all the overhead costs using activity-based costing and the three cost drivers,that is,number of clients,number of transactions with clients,and computer hours? Show all your supporting calculations and/or analysis,including any necessary explanation.

Definitions:

Q15: What was the total period cost for

Q25: Which of the following statements about overhead

Q53: What was the total contribution margin for

Q61: If sales increase by 100 units,by how

Q70: (Appendix 6A)The cost per equivalent unit for

Q82: How much of any underapplied or overapplied

Q94: During the last year,Hansen Company had operating

Q103: Which of the following is normally included

Q103: What are the budgeted cash receipts for

Q167: _ includes reporting and interpreting information that