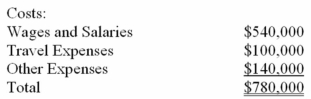

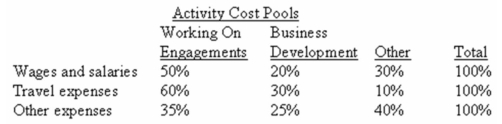

Fife & Jones PLC,a consulting firm,uses an activity-based costing in which there are three activity cost pools.The company has provided the following data concerning its costs and its activity-based costing system:

Distribution of Resource Consumption:

Required:

a)How much cost,in total,would be allocated to the Working On Engagements activity cost pool?

b)How much cost,in total,would be allocated to the Business Development activity cost pool?

c)How much cost,in total,would be allocated to the Other activity cost pool?

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed.

Connecting Affiliations

Relationships or linkages between entities or organizations that facilitate communication, cooperation, or coordination.

Mutual Ownership

A form of corporate structure where customers of the entity own mutual interests in the company, such as in mutual insurance companies or cooperatives.

Consolidated Group

A group of companies that are controlled by a single parent company, which presents their financial statements as if they were a single economic entity.

Q9: Costs incurred at which of the following

Q15: The overhead cost per unit of Product

Q47: Once an action plan is implemented, it

Q93: The following information relates to Clyde Corporation,which

Q101: Under absorption costing,what was the reported operating

Q106: What are the total disbursements during the

Q116: amortization of the wood used in the

Q137: What is the overall contribution margin ratio

Q225: The break-even point in units can be

Q231: Spencer Company's most recent monthly contribution format