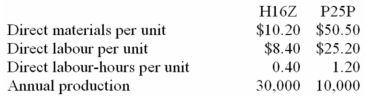

(Appendix 7A)Welk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,H16Z and P25P,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labour-hours for the year is 24,000.

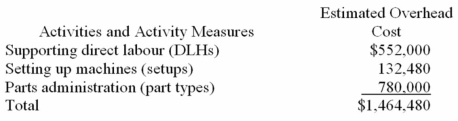

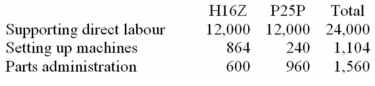

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Definitions:

Payments

Transactions or transfers of money that are made to settle a debt or an account.

Double-Entry Bookkeeping System

A method of accounting where every transaction is recorded in at least two accounts, with one account being debited and another credited, ensuring the accounting equation balances.

Single-Entry System

An accounting method where each financial transaction is recorded with only one entry, making it simpler but less detailed than double-entry systems.

Accounting Program

An educational curriculum designed to prepare students for careers in financial reporting, auditing, tax, and management accounting.

Q10: What are the equivalent units of production

Q27: Changing the selling price of a product.

Q29: (Appendix 7A)Werger Manufacturing Corporation has a traditional

Q67: What is the cost of raw materials

Q79: If Dorian Company desires a monthly operating

Q84: There are many aspects of a company

Q98: Friden Company has budgeted sales and production

Q198: What is the break-even point in sales

Q252: How is the margin of safety percentage

Q275: The contribution margin ratio always increases when