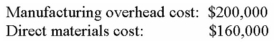

The Collins Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production.At the beginning of the most recent year,the following estimates were made as a basis for computing the predetermined overhead rate for the year:

The following transactions took place during the year (all purchases and services were acquired on account):

a. )Raw materials purchased: $86,000.

b. )Raw materials requisitioned for use in production (all direct materials): $98,000.

c. )Utility costs incurred in the factory: $15,000.

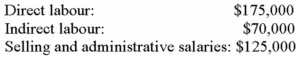

d. )Salaries and wages incurred as follows:

e. )Maintenance costs incurred in the factory: $15,000.

f. )Advertising costs incurred: $89,000.

g. )Depreciation recorded for the year: $80,000,of which 80% relates to factory assets and the remainder relates to selling and administrative assets.

h. )Rental cost incurred on buildings: $70,000 (75% of the space is occupied by the factory,and 25% is occupied by sales and administration).

i. )Miscellaneous selling and administrative costs incurred: $11,000.

j. )Manufacturing overhead cost was applied to jobs as per company policy.

k. )Cost of goods manufactured for the year: $500,000.

l. )Sales for the year (all on account): $1,000,000.These goods cost $600,000 to manufacture.

Required:

Prepare journal entries to record the information above.Key your entries by the letters a through l.

Definitions:

Individual

An Individual refers to a single, distinct person separate from a group or society, often considered in terms of unique psychological characteristics.

Group Polarization

The phenomenon where a group's prevailing attitudes or beliefs become stronger or more extreme following group discussions.

Moderately Liberal

Describes political or social views that favor reform and progress within a framework of traditional principles, but not to an extreme extent.

College

An institution of higher education where students pursue degrees in various fields.

Q38: Gilford,Inc. ,uses a job-order costing system.Costs going

Q43: In order to improve the accuracy of

Q49: Although variable costing is NOT permitted for

Q56: Y Company reported operating income for Year

Q71: Under the absorption costing method,what was the

Q82: A company increased the selling price for

Q179: The following monthly data are available for

Q196: When interpreting a CVP graph which of

Q298: The contribution margin ratio always increases when

Q313: How is the degree of operating leverage