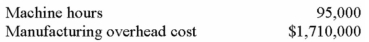

Scanlon Company has a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours.The following estimates were used in preparing the predetermined overhead rate for the most recent year:

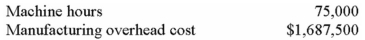

During the most recent year,a severe recession in the company's industry caused the curtailment of production and a buildup of inventory in the company's warehouses.The company's cost records revealed the following actual cost and operating data for the year:

Required:

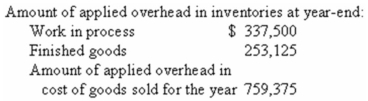

(a. )Compute the company's predetermined overhead rate for the year and the amount of under- or overapplied overhead for the year.

(b. )Determine the difference between net income for the year if the under- or overapplied overhead is allocated to the appropriate accounts rather than closed out directly to Cost of Goods Sold.

Definitions:

First Year

Refers to the initial period or freshman year in educational institutions, marking the beginning of a student’s journey in college or university.

Genetically Male Children

Individuals with the XY chromosome pair, which typically results in the development of male physical and reproductive characteristics.

Surgically Altered

Describes a change or modification in the body made through surgical intervention, often for health, cosmetic, or therapeutic reasons.

Feminine Toys

Feminine toys are typically characterized by cultural norms as toys that are more likely to be played with by girls; they often include dolls, kitchen sets, and items associated with domestic and caregiving roles.

Q29: What is the cost of goods sold?<br>A)

Q39: Job-costing systems tend to produce more accurate

Q51: What is the expected contribution margin next

Q78: Indiana Corporation produces a single product that

Q80: In process costing,the same equivalent units figure

Q91: What was the contribution margin per unit?<br>A)

Q203: The break-even point in sales for Rice

Q328: What is the company's margin of safety

Q372: The following is Allison Corporation's contribution format

Q377: Carver Company produces a product that sells