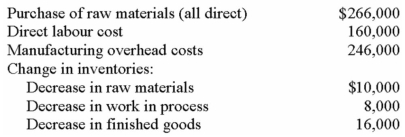

X Company reported the following actual cost data for the year:

X Company used a 150% predetermined overhead rate based on direct labour cost.The rate was based on annual estimated overhead cost and direct labour cost of $252,000 and $168,000,respectively.

Required:

a.Calculate the cost of goods manufactured.

b.What was the cost of goods sold before adjusting for any under or overapplied overhead?

c.By how much was manufacturing overhead cost under or overapplied?

d.Prepare a summary journal entry to close any under or overapplied manufacturing overhead cost to cost of goods sold.Is such an entry appropriate in this situation? Why or why not?

e.Analyze the under or overapplied manufacturing overhead costs calculated in part c above into two separate components: amount due to incorrect estimate of the annual manufacturing overhead costs and an amount due to incorrect estimate of the annual direct labour cost.

Definitions:

User Benefits

Advantages or positive outcomes that end-users experience from using a product, service, or system.

Brand Tracking

The process of monitoring changes in consumer perceptions and attitudes towards a brand over time, often through regular surveys.

Comparative Performance

is the evaluation of the effectiveness or success of a product or service in relation to its competitors.

Health Check

An evaluation or assessment of the current state of health, whether for an individual, system, or organization, to identify areas needing improvement.

Q9: Costs incurred at which of the following

Q19: The cost per unit of Product B

Q21: How much cost,in total,should NOT be allocated

Q23: Pabbatti Company,which has only one product,has provided

Q69: What is the best estimate of the

Q76: Harker Company uses the weighted-average method in

Q93: In activity-based costing,as in traditional costing systems,non-manufacturing

Q101: In traditional costing systems,all manufacturing costs are

Q114: Barnes Company sells three products: A,B,and C.Budgeted

Q240: What is the company's degree of operating