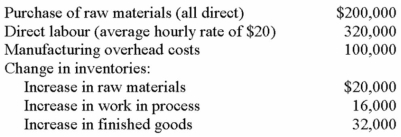

Y Company reported the following actual costs data for the year:

Y Company used a predetermined overhead rate based on direct labour hours.Estimated annual manufacturing overhead cost and direct labour hours were $150,000 and 20,000,respectively.

Required:

a.What was the pre-determined manufacturing overhead rate?

b.Calculate the cost of goods manufactured.

c.What was the cost of goods sold before adjusting for any under or overapplied overhead?

d.By how much was manufacturing overhead cost under or overapplied?

e.Prepare a summary journal entry to close any under or overapplied manufacturing overhead cost to cost of goods sold.Is such an entry appropriate in this situation? Why or why not?

f.Analyze the under or overapplied manufacturing overhead costs calculated in part c above into two separate components: amount due to incorrect estimate of the annual manufacturing overhead costs and an amount due to incorrect estimate of the annual direct labour cost.

Definitions:

Profit-Oriented Entity

A business whose primary goal is to generate profits rather than focusing on other goals such as social impact or environmental sustainability.

Fair Value

The financial return from disposing of an asset or expense of transferring a liability in a systematic transaction with market entities at the point of measurement.

Carrying Value

The book value of assets and liabilities as reported on the balance sheet, reflecting original cost adjusted for depreciation, amortization, and impairments.

Restricted Fund

Funds that are earmarked for a specific purpose by the donor or governing body and cannot be used for general expenses.

Q33: (Appendix 6B)Units can disappear because of evaporation,losses,or

Q40: Carver Inc.uses the weighted-average method in its

Q67: Which of the following statements is true

Q77: Belli-Pitt,Inc produces a single product.The results of

Q113: Which of the following activity levels is

Q114: Barnes Company sells three products: A,B,and C.Budgeted

Q127: When the number of units in work-in-process

Q259: The formula for the break-even point is

Q336: What is the break-even point in units

Q356: Ostler Company's operating income last year was