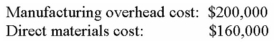

The Collins Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production.At the beginning of the most recent year,the following estimates were made as a basis for computing the predetermined overhead rate for the year:

The following transactions took place during the year (all purchases and services were acquired on account):

a. )Raw materials purchased: $86,000.

b. )Raw materials requisitioned for use in production (all direct materials): $98,000.

c. )Utility costs incurred in the factory: $15,000.

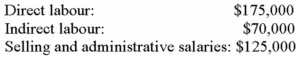

d. )Salaries and wages incurred as follows:

e. )Maintenance costs incurred in the factory: $15,000.

f. )Advertising costs incurred: $89,000.

g. )Depreciation recorded for the year: $80,000,of which 80% relates to factory assets and the remainder relates to selling and administrative assets.

h. )Rental cost incurred on buildings: $70,000 (75% of the space is occupied by the factory,and 25% is occupied by sales and administration).

i. )Miscellaneous selling and administrative costs incurred: $11,000.

j. )Manufacturing overhead cost was applied to jobs as per company policy.

k. )Cost of goods manufactured for the year: $500,000.

l. )Sales for the year (all on account): $1,000,000.These goods cost $600,000 to manufacture.

Required:

Prepare journal entries to record the information above.Key your entries by the letters a through l.

Definitions:

Average Arrival Rate

The average rate at which entities (such as customers or products) arrive at a specific point or system over a defined period.

M/D/1

A notation in queue theory representing a system with a single server, where arrivals are Markovian (Poisson process), service times are deterministically fixed, and there is one server.

Constant Service Time

A condition in queuing theory where the time required to serve each customer is the same and does not vary.

Units Arrive

Pertains to the process or moment when manufactured goods or inventory items reach a designated location, such as a warehouse.

Q6: What is the company's degree of operating

Q20: Which of the following is an example

Q68: What was the total period cost for

Q89: Contribution margin is the excess of revenues

Q92: Under variable costing,what was the company's operating

Q95: The following journal entry would be made

Q96: Under variable costing,the impact of both fixed

Q111: What was the total cost of the

Q119: Toyworld manufactures and sells a line of

Q317: What is the company's degree of operating