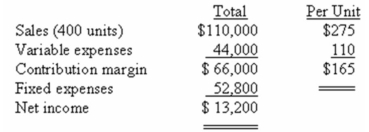

The following monthly data are available for the Challenger Company and its only product,Product SW:

Required:

a)Without resorting to calculations,what is the total contribution margin at the break-even point?

b)Management is contemplating the use of plastic gearing rather than metal gearing in Product SW.This change would reduce variable costs by $15.The company's marketing manager predicts that this would reduce the overall quality of the product and thus would result in a decline in sales to a level of 350 units per month.Should this change be made?

c)Assume that Challenger Company is currently selling 400 units of Product SW per month.Management wants to increase sales and feels that this can be done by cutting the selling price by $25 per unit and increasing the advertising budget by $20,000 per month.Management believes that these actions will increase unit sales by 50%.Should these changes be made?

d)Assume that Challenger Company is currently selling 400 units of Product SW.Management wants to automate a portion of the production process for Product SW.The new equipment would reduce direct labour costs by $20 per unit but would result in a monthly rental cost for the new robotic equipment of $10,000.Management believes that the new equipment will increase the reliability of Product SW,thus resulting in an increase in monthly sales of 12%.Should these changes be made?

Definitions:

U.S. Dollar

The currency unit of the United States, widely used as a global reserve currency.

Market for Euros

The foreign exchange market where Euros are traded for other currencies, influenced by factors such as interest rates, economic stability, and trade balances.

U.S. Cars

Vehicles manufactured by companies based in the United States, reflecting the nation's automotive industry characteristics.

Q6: What is the company's degree of operating

Q35: What is the cost of goods sold

Q50: (Appendix 6A)Using the FIFO method,what are the

Q62: (Appendix 6B)The cost per equivalent unit will

Q63: What is the unit contribution margin per

Q65: What is the cost of goods manufactured?<br>A)

Q81: Significant reductions in committed fixed costs can

Q199: Sales = Variable expenses + Fixed expenses

Q238: What is the break-even point in sales

Q243: Which of the following is defined as