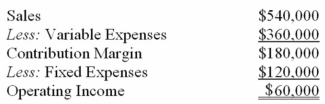

Belli-Pitt,Inc produces a single product.The results of the company's operations for a typical month are summarized in contribution format as follows:

The company produced and sold 120,000 kilograms of product during the month.There were no beginning or ending inventories.

Required:

a)Given the present situation,compute

1 The break-even sales in kilograms.

2 The break-even sales in dollars.

3 The sales in kilograms that would be required to produce operating income of $90,000.

4 The margin of safety in dollars.

b)An important part of processing is performed by a machine that is currently being leased for $20,000 per month.Belli-Pitt has been offered an arrangement whereby it would pay $0.10 royalty per kilogram processed by the machine rather than the monthly lease.

1 Should the company choose the lease or the royalty plan?

2 Under the royalty plan,compute the break-even point in kilograms.

3 Under the royalty plan,compute the break-even point in dollars.

4 Under the royalty plan,determine the sales in kilograms that would be required to produce operating income of $90,000.

Definitions:

Biopsy

A medical procedure that involves taking a small sample of tissue for examination to diagnose diseases.

Tympanic Membrane

The thin layer of tissue that separates the external ear from the middle ear, commonly known as the eardrum.

Fungal Infection

An infection caused by fungi, which can affect any part of the body, including the skin, nails, and internal organs.

Subjective Vertigo

A sensation of movement or spinning that is felt by the individual, often described as feeling dizzy or that the world is moving around them.

Q19: Trapp Company uses the weighted-average method in

Q52: Which of the following would be considered

Q56: EMD Corporation manufactures two products,Product S and

Q58: Qabar Company,which has only one product,has provided

Q84: The total production cost per unit of

Q94: The cost structure of Sackville Manufacturing Company

Q99: Ingersol Draperies makes custom draperies for homes

Q183: What is the unit contribution margin per

Q356: Ostler Company's operating income last year was

Q361: The following monthly data are available for