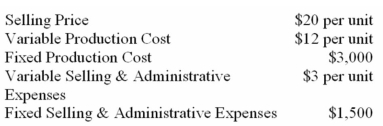

The following data pertain to last month's operations:

What is the break-even point in dollars?

Definitions:

Tax Bracket

A range of incomes taxed at a given rate by the government, with higher incomes typically taxed at higher rates.

Salary Contribution

The portion of an individual's salary that is allocated towards investment, savings, or retirement plans, often in a structured or mandated manner.

403b Plan

A tax-advantaged retirement savings plan available to employees of educational institutions and certain non-profit organizations.

Salary Reduction

A decrease in the amount of an employee's pay before taxes as agreed upon by the employer and employee, often in exchange for some benefit such as enhanced retirement contributions.

Q12: Assuming that cost of goods sold for

Q38: What does conversion cost consist of?<br>A) Manufacturing

Q50: The contribution approach to constructing an income

Q53: Harrell Company uses a predetermined overhead rate

Q71: What was the cost of goods sold

Q72: The break-even in sales dollars for the

Q79: What amount of direct labour cost was

Q130: The degree of operating leverage for July

Q183: Marcell Company's inventory turnover for Year 2

Q222: Loren Company's single product has a selling