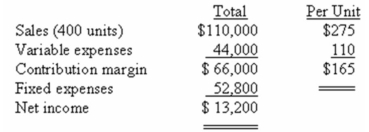

The following monthly data are available for the Challenger Company and its only product,Product SW:

Required:

a)Without resorting to calculations,what is the total contribution margin at the break-even point?

b)Management is contemplating the use of plastic gearing rather than metal gearing in Product SW.This change would reduce variable costs by $15.The company's marketing manager predicts that this would reduce the overall quality of the product and thus would result in a decline in sales to a level of 350 units per month.Should this change be made?

c)Assume that Challenger Company is currently selling 400 units of Product SW per month.Management wants to increase sales and feels that this can be done by cutting the selling price by $25 per unit and increasing the advertising budget by $20,000 per month.Management believes that these actions will increase unit sales by 50%.Should these changes be made?

d)Assume that Challenger Company is currently selling 400 units of Product SW.Management wants to automate a portion of the production process for Product SW.The new equipment would reduce direct labour costs by $20 per unit but would result in a monthly rental cost for the new robotic equipment of $10,000.Management believes that the new equipment will increase the reliability of Product SW,thus resulting in an increase in monthly sales of 12%.Should these changes be made?

Definitions:

Low-Unit-Cost Items

Items or inventory that individually have a low value or cost but may collectively represent a significant value.

Inventory Cost Formula

An equation used to calculate the cost of ending inventory, taking into account the cost of goods sold, purchases, and beginning inventory, enabling accurate financial reporting and analysis.

Inventory Cost Formula

A method utilized for valuing the cost of goods sold and ending inventory, often using techniques such as First-In, First-Out (FIFO) or Last-In, First-Out (LIFO).

Cumulative Cost

The total cost accumulated for a project or an activity over a period of time.

Q3: Carlo Company uses a predetermined overhead rate

Q19: The concept of the relevant range does

Q20: Rossiter Company failed to record a credit

Q26: Miller Company manufactures a product for which

Q50: The contribution approach to constructing an income

Q64: Which of the following would be classified

Q70: The cost per unit of Product A

Q89: (Appendix 6A)Oxyrom Company uses the FIFO method

Q299: Dodero Company produces a single product that

Q322: The break-even point is closest to which