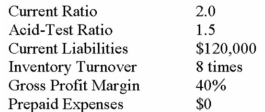

Selected data from Sheridan Corporation's year-end financial statements are presented below.The difference between average and ending inventory is immaterial.

What were Sheridan's sales for the year?

Definitions:

Predetermined Overhead Rate

A rate calculated before the accounting period begins, used to allocate manufacturing overhead costs to individual products based on a certain activity base.

Normal Cost System

A costing system in which overhead costs are applied to a job by multiplying a predetermined overhead rate by the actual amount of the allocation base incurred by the job.

Job Cost Sheet

A document that records the materials, labor, and manufacturing overhead costs assigned to each individual job in production.

Predetermined Overhead Rate

An established cost allocation rate that assigns expected indirect costs to products or services based on a chosen activity base.

Q1: What is the sunk cost in this

Q16: (Appendix 11A)What allocation method recognizes that service

Q19: Selected data from Sheridan Corporation's year-end financial

Q26: (Appendix 11A)Parker Company has two service departments-cafeteria

Q40: Gata Co.plans to discontinue a department that

Q45: What was the balance of the finished

Q57: Which of the following assumptions is implicit

Q87: The following data pertain to activity and

Q161: (Appendix 11A)What will be the total appraisal

Q309: The break-even point in sales for Rice