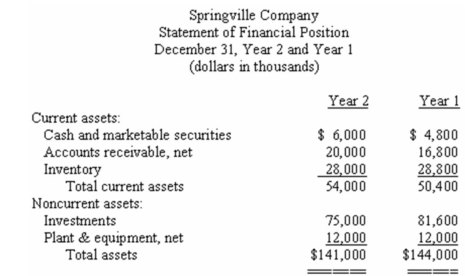

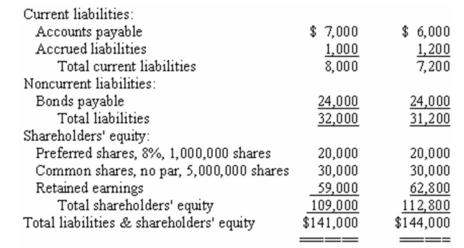

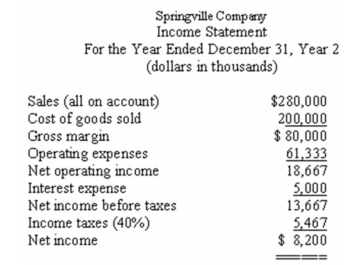

Comparative financial statements for Springville Company for the last two years appear below.The market price of Springville's common shares was $25 per share on December 31,Year 2.During Year 2,dividends of $2,000,000 were paid to preferred shareholders and $10,000,000 to common shareholders.

Required:

Calculate the following for Year 2:

a)Dividend payout ratio.

b)Dividend yield ratio.

c)Price-earnings ratio.

d)Accounts receivable turnover.

e)Inventory turnover.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Was financial leverage positive or negative for the year? Explain.

Definitions:

Neurotransmitter

A chemical substance that transmits nerve impulses across a synapse between two neurons, playing a crucial role in the functioning of the nervous system.

Serotonin

A neurotransmitter in the brain that affects mood, emotion, sleep, and appetite, often associated with feelings of well-being and happiness.

Egalitarian Relationships

Partnerships based on the principle of equality, where power and responsibilities are shared evenly among partners.

Androcentric Society

A society that is centered around male interests, values, and perspectives, often marginalizing other genders.

Q20: The performance of the manager of Division

Q39: (Appendix 13A)Benz Company is considering the purchase

Q53: How should the cost of the fire

Q70: A sunk cost is a cost that

Q80: Shipping expense is $9,000 for 8,000 kilograms

Q128: The following data pertain to Wistron Company's

Q135: When using the internal rate of return

Q178: Last year,Jabber Company had a net income

Q322: The break-even point is closest to which

Q354: In two companies making the same product