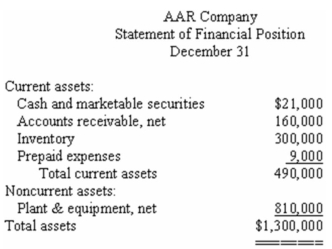

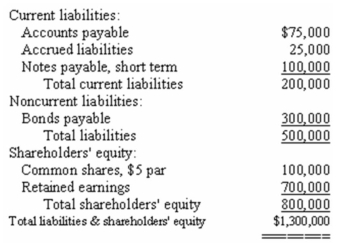

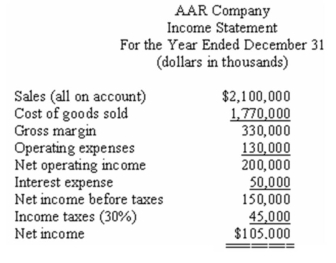

Financial statements for AAR Company appear below:

AAR Company paid dividends of $3.15 per share during the year.The market price of the company's common shares at December 31 was $63 per share.Total assets at the beginning of the year were $1,100,000,and total shareholders' equity was $725,000.The balance of accounts receivable at the beginning of the year was $150,000.The balance in inventory at the beginning of the year was $250,000.

Required:

Calculate the following:

a)Current ratio.

b)Acid-test (quick)ratio.

c)Average collection period (age of receivables).

d)Inventory turnover.

e)Times interest earned.

f)Debt-to-equity ratio.

g)Dividend payout ratio.

h)Price-earnings ratio.

i)Return on total assets.

j)Return on common shareholders' equity.

k)Was financial leverage positive or negative for the year? Explain.

Definitions:

Echo

A sound that is reflected off a surface and heard again, often used to measure distance or create special audio effects.

Sensory Registers

The initial process where sensory information is stored very briefly before it is processed further or discarded.

Encoding

The process of converting information into a form that can be stored in memory, such as transforming thoughts into a sequence of words.

Attention

The cognitive process of concentrating on one aspect of the environment while ignoring other stimuli.

Q20: Rossiter Company failed to record a credit

Q46: (Appendix 12A)Magner,Inc.uses the absorption costing approach to

Q71: What was the cost of goods manufactured

Q101: What is the contribution margin ratio for

Q112: Marcell Company's average sale period (turnover in

Q134: (Appendix 13B)Last year,a firm had taxable cash

Q138: When the net present value method is

Q160: Dragin Company's working capital is $36,000,and its

Q178: Last year,Jabber Company had a net income

Q179: Brachlan Company's net income last year was