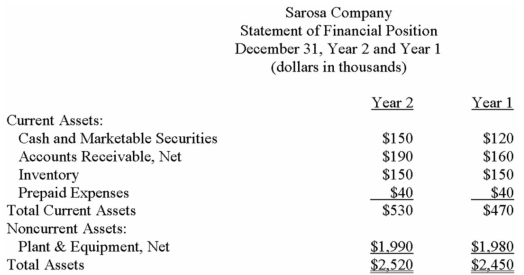

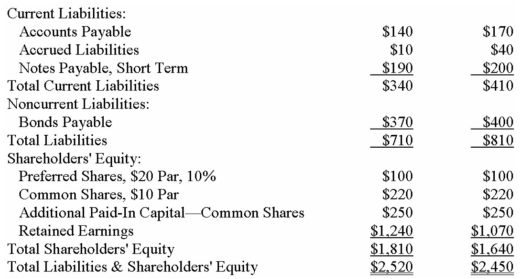

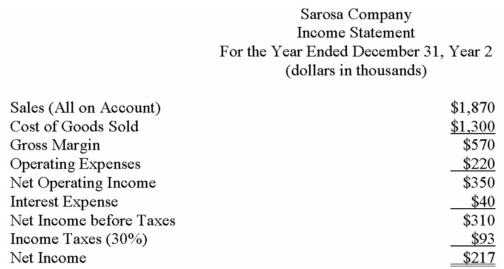

Financial statements for Sarosa Company appear below:

Required:

a)Calculate Sarosa Company's return on total assets for Year 2.

b)Calculate Sarosa Company's return on common shareholders' equity for Year 2.

c)Financial leverage was positive for Year 2.Why?

d)Assume all current liabilities are interest free and that the interest expense of $40 is for the bonds payable.

(i)Calculate the dollar amount of the financial leverage (in $1,000)

(ii)Allocate the dollar amount of the financial leverage to the following sources of financing: Preferred Shares,Bonds Payable,and Current Liabilities (rounded to the nearest $1,000)

Definitions:

Peripheral IV Line

A medical device inserted into a peripheral vein, typically in the hand or arm, to administer medications, fluids, or nutrients directly into the bloodstream.

Red Streak

A term often referring to the visual sign of inflammation or infection, such as lymphangitis, where a red line appears on the skin extending from a source of infection.

Lower Respiratory Infection

An infection affecting the airways and lungs, such as bronchitis or pneumonia, leading to symptoms like coughing and difficulty breathing.

High Fowler's Position

A patient's position where the backrest is raised to 60-90 degrees, aiding in respiratory function and used during feeding and certain medical procedures.

Q3: (Appendix 11A)What will be the total external

Q6: What is the total fixed overhead cost

Q30: Laroche Company's return on total assets for

Q37: Mateo Company's average cost per unit is

Q47: Joint production costs are relevant costs in

Q58: (Appendix 12A)The target selling price for one

Q61: Expense A is a fixed cost;expense B

Q74: What was the net income (in thousands

Q76: What were the total sales in Store

Q121: Assuming that a segment has both variable