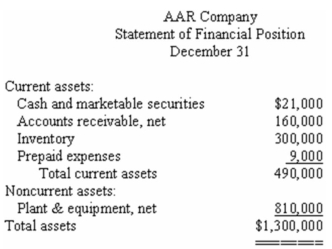

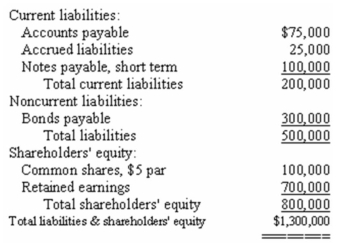

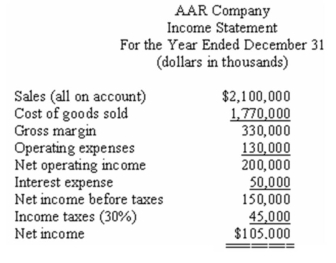

Financial statements for AAR Company appear below:

AAR Company paid dividends of $3.15 per share during the year.The market price of the company's common shares at December 31 was $63 per share.Total assets at the beginning of the year were $1,100,000,and total shareholders' equity was $725,000.The balance of accounts receivable at the beginning of the year was $150,000.The balance in inventory at the beginning of the year was $250,000.

Required:

Calculate the following:

a)Current ratio.

b)Acid-test (quick)ratio.

c)Average collection period (age of receivables).

d)Inventory turnover.

e)Times interest earned.

f)Debt-to-equity ratio.

g)Dividend payout ratio.

h)Price-earnings ratio.

i)Return on total assets.

j)Return on common shareholders' equity.

k)Was financial leverage positive or negative for the year? Explain.

Definitions:

Slide Sorter View

A feature in presentation software that displays thumbnail versions of slides, allowing users to easily organize and reorder their slides.

Text Slides

Slides in a presentation primarily composed of textual information as opposed to images or multimedia.

Builds

Influences that manage the unveiling of text, visuals, and various components on specific slides.

Font Size

The size of the text characters in a document or webpage, typically measured in points (pt), affecting readability and visual appeal.

Q34: Starrs Company has current assets of $300,000

Q34: The Central Valley Company is a merchandising

Q45: What was the balance of the finished

Q63: The advertising costs incurred by Pepsi to

Q87: Larosa Company's book value per share at

Q161: Arlberg Company's net income last year was

Q172: (Appendix 11A)What will be the total prevention

Q174: (Appendix 11A)Total costs in the Personnel Department

Q350: If the company wants its margin of

Q353: What is the break-even point in sales