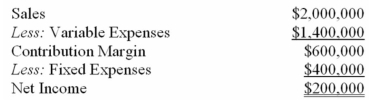

(Appendix 13A)Ursus,Inc.is considering a project that would have a ten-year life and would require a $2,000,000 investment in equipment.At the end of ten years,the project would terminate and the equipment would have no salvage value.The project would provide net income each year as follows:

All of the above items,except for depreciation of $200,000 a year,represent cash flows.The depreciation is included in the fixed expenses.The company's required rate of return is 12%.(Ignore income taxes in this problem. )

Required:

a)What is the project's net present value?

b)What is the project's internal rate of return?

c)What is the project's payback period?

d)What is the project's simple rate of return?

Definitions:

Auxin

A class of plant hormones that play a key role in coordinating growth and behavioral processes in the plant's life cycle, such as cell elongation.

Brassinosteroids

A class of growth-promoting, steroid hormones in plants, influencing cell elongation, division, and development.

Steroids

A class of lipophilic organic molecules that play diverse roles in the body, including as hormones and components of cell membranes.

Ethylene

A gaseous plant hormone involved in various processes such as ripening of fruits, flowering, and leaf abscission.

Q44: In order for a cost to be

Q49: (Appendix 13A and 13B)What is the approximate

Q86: (Appendix 11A)What will be the total internal

Q86: To what does the term differential cost

Q106: (Appendix 11A)Internal failure costs result when a

Q146: A decrease in denominator level of activity

Q152: (Appendix 10B)A favourable labour efficiency variance would

Q157: Oratz Company's earnings per common share for

Q171: What was the labour rate variance for

Q192: What were the direct materials quantity variances