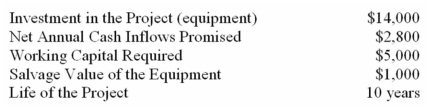

(Appendix 13A) The following data pertain to an investment proposal:

The working capital would be released for use elsewhere when the project is completed.What is the net present value of the project,using a discount rate of 8%? (Ignore income taxes in this problem. ) (Do not round your intermediate calculations and round the final answer to the nearest whole dollar. )

Definitions:

Financial Leverage

Financial leverage is the use of borrowed funds to increase an investment's potential return, which also increases the risk of loss.

Dividend Discount Model

A method of valuing a company's stock price by using predicted dividends and discounting them back to present value.

Myron Gordon

An economist best known for developing the Gordon Growth Model, which is used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate.

Burton Malkiel

An American economist and writer, most famous for his classic finance book "A Random Walk Down Wall Street."

Q13: Lusk Company produces and sells 15,000 units

Q33: (Appendix 12A)The target selling price based on

Q34: The Central Valley Company is a merchandising

Q56: The following information was provided by Wilson

Q95: Eral Company has $17,000 in cash,$3,000 in

Q99: What was the variable overhead efficiency variance?<br>A)

Q105: Segmented statements for internal use should be

Q126: (Appendix 13B)A company had tax-deductible cash expenses

Q166: For the past year,what was the turnover?<br>A)

Q401: Kilimanjaro Company (KC)makes and sells one product: