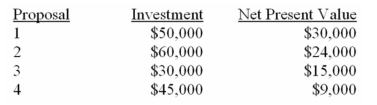

Information on four investment proposals is given below:

What are preference rankings of the four proposals according to the profitability index?

Definitions:

Total Assets

The sum of all current and non-current assets owned by a company, indicating the total resources available for use in operations.

Market To Book Ratio

A ratio used to compare a company's market value (market capitalization) to its book value, providing insight into how the market values the company's equity.

Book Value Per Share

The financial measure that indicates the per-share value of a company's equity available to shareholders, calculated by dividing net assets by the total number of outstanding shares.

Total Market Value

The aggregate valuation of a company, measured by multiplying its current share price by its total outstanding shares.

Q11: Financial statements for Rarity Company appear below:

Q14: Unified Parcel,Inc.operates a local parcel delivery service.The

Q45: Information concerning the common shares of Morris

Q57: Which of the following assumptions is implicit

Q58: The following data have been taken from

Q70: A sunk cost is a cost that

Q72: During the month of May,Bennett Manufacturing Company

Q80: What was the residual income?<br>A) $40,000.<br>B) $80,000.<br>C)

Q171: Narita Company's debt-to-equity ratio at the end

Q259: The formula for the break-even point is