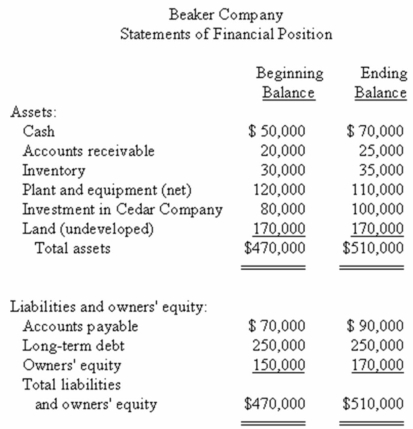

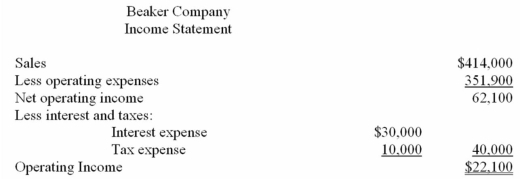

Financial data for Beaker Company for last year appear below:

The company paid dividends of $2,100 last year.The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company.

Required:

a)Compute the company's margin,turnover,and return on investment for last year.

b)The Board of Directors of Beaker Company have set a minimum required return of 20%.What was the company's residual income last year?

Definitions:

Linear Relationship

A type of correlation where there is a constant rate of change between two variables.

Dependent Variable

A variable in an experiment or study whose changes are determined by the presence or manipulation of one or more independent variables.

Independent Variable

A variable in statistical analysis that is manipulated or categorized to observe its effect on a dependent variable.

Standard Deviation

A measure that is used to quantify the amount of variation or dispersion of a set of data values.

Q15: Corporate divisions, like the media division of

Q29: (Appendix 13A and 13B)Suppose that your company

Q42: Lean production is often called just-in-time production.

Q49: If the new product is added next

Q52: The Porter Company has a standard cost

Q82: Suppose that total regular sales of jigs

Q86: Patridge Company uses a standard cost system

Q106: Information on Kennedy Company's direct material costs

Q137: (Appendix 13A)The net present value of this

Q172: M.K.Berry is the managing director of CE