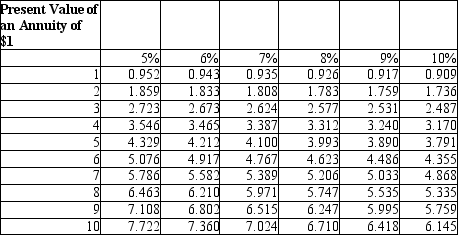

Beta Company is considering an investment in a new storage facility that would require an initial outlay of $250,000, and would yield yearly cash flows of $48,000 for 8 years. Beta uses a discount rate of 7% What is the NPV of the investment?

Definitions:

Q10: A-1 Sports Vehicles Manufacturing produces a specialty

Q15: If a company reduces its fixed costs,

Q22: The cash budget may be used to

Q39: What is value engineering?<br>A)Reevaluating market strategies to

Q63: Jim wants to invest $5,000 at the

Q70: Assume Division 1 of the XYZ Company

Q92: Western Outfitters Mountain Sports projected 2011 sales

Q119: Alexandria Semiconductors produces 300,000 hi-tech computer chips

Q135: The sales volume variance is the difference

Q150: Juan has just received a prize which