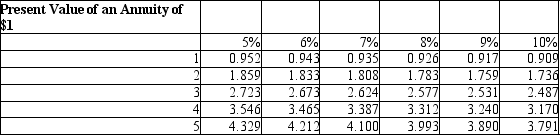

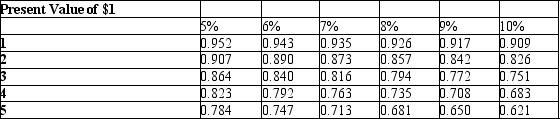

Marsh Products is evaluating an investment in new production machinery. The initial investment is $250,000 and will yield cash flows of $60,000 per year for a 5 year period. At the end of 5 years, the machinery will be sold and has expected residual value of $40,000. Marsh uses a discount rate of 7%. What is the net present value of the investment?

Definitions:

Allotment

The distribution or assignment of a portion of something, often referring to shares of stock, land, or time.

Incorporation

Establishing a business entity as a corporation, which holds legal identity separate from its shareholders, enabling it to own property, sue, or be sued.

Advantages

Advantages refer to the beneficial factors or positive outcomes resulting from a specific action, decision, or situation.

Franchising

Arrangements based on contracts of service and the supply of products between larger and smaller units of one organization.

Q16: The rate of return is the only

Q19: If a product line has a negative

Q40: Seven Seas Company manufactures 100 luxury yachts

Q44: Full-product cost includes all manufacturing costs plus

Q76: Seven Seas Company manufactures 100 luxury yachts

Q112: Easy Cook Company manufactures two products: toaster

Q132: In making product mix decisions under constraining

Q136: Centurion Company is considering a mineral extraction

Q153: Paula sells hand-knitted scarves at the flea

Q160: Which of the following is an example