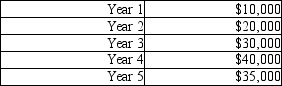

MacNamara Development Company is evaluating a possible investment in a construction project. The cost will be $100,000, and it will generate cash flows as follows:  The VP for construction believes this project has an internal rate of return somewhere in the range of 7% to 10%, but has asked the Controller to crunch the numbers. Using the trial and error method, and the PV factors shown here, determine what the IRR of this project is.

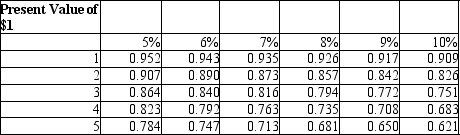

The VP for construction believes this project has an internal rate of return somewhere in the range of 7% to 10%, but has asked the Controller to crunch the numbers. Using the trial and error method, and the PV factors shown here, determine what the IRR of this project is. Choose the rate below which comes closest to the actual IRR.

Choose the rate below which comes closest to the actual IRR.

Definitions:

Allowance Method

The Allowance Method is an accounting technique that estimates and accounts for doubtful accounts, reducing the accounts receivable to its net realizable value.

Going Concern Assumption

An accounting principle assuming that an entity will continue to operate for the foreseeable future.

Direct Method

An approach to preparing the cash flow statement where actual cash flows from operating activities are listed.

Q8: Activity-based management can be used to make

Q19: AAA Metal Bearings produces two sizes of

Q30: A department store has budgeted cost of

Q74: When comparing several investments with the same

Q82: Compound interest used in discounted cash flow

Q92: The cash budget can be prepared before

Q125: If Arthur Godfried invests $1,000 today at

Q143: Cardinal Corporation produces birdhouses. It takes 1

Q152: If you invest $3,000 today at 7%

Q165: Dalian Company provides the following information: <img