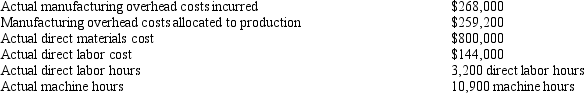

Petraeus Fabrication Company has provided the following information for the year 2012:  Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Definitions:

Equity Method

An accounting technique used for recording investments in which the investor has significant influence but not total control over the investee.

Deferred Income Tax

An accounting concept that represents the difference between taxes payable and tax expense due to timing differences in recognizing revenues and expenses.

Tax Rate

The rate at which taxes are levied on an individual or a company's income.

Equity Method

An accounting technique used to record investments in other companies, where the investment is significant but does not result in full control or majority ownership, typically 20% to 50% of the investee's voting stock.

Q15: Which of the following factors might suggest

Q16: Budget preparation is a part of the

Q21: Target pricing is based on the cost

Q42: Accounting, legal and administrative costs are included

Q43: Transportation costs to ship products to customers

Q69: Johnson Production Company uses just-in-time production and

Q98: Please complete a vertical analysis on the

Q105: Darrius Travel Services provided the following information:<br>Cost

Q113: Falstaff Products estimated manufacturing overhead costs for

Q116: Shine Bright Company has three product lines-D,