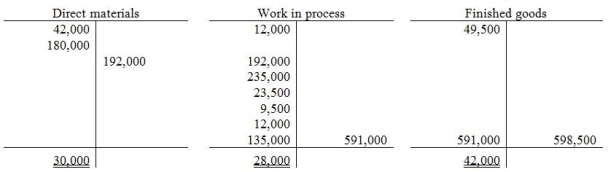

T-accounts for the inventory accounts of the Arturo Manufacturing Company are shown below. This data represents transactions for the year of 2012.  Based on the data shown here, what was the amount of the cost of goods manufactured?

Based on the data shown here, what was the amount of the cost of goods manufactured?

Definitions:

Invested

Assigning monetary assets with the prospect of gaining returns or profit.

Investment Value

The worth of an asset or security based on its potential to generate income, appreciation, or other benefits to an investor.

December

The twelfth and final month of the year in the Gregorian calendar.

Interest

A charge for borrowed money, generally a percentage of the borrowed amount.

Q10: A-1 Sports Vehicles Manufacturing produces a specialty

Q15: At March 31, 2014, the Park Place

Q17: Management is accountable to its employees in

Q25: Halcyon Company just completed job number 10B.

Q39: The excess of a company's current assets

Q48: Which of the following applies to goods

Q50: Which of the following BEST describes operating

Q64: A company has 6,000 shares of common

Q129: Costs incurred when the company corrects for

Q151: The Arlington Company prepared a common-size income