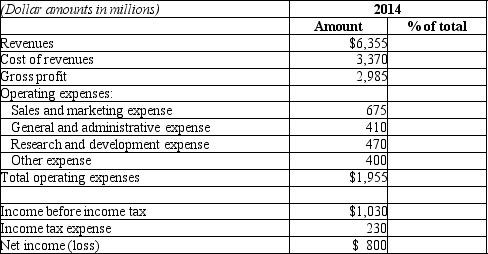

Please complete the vertical analysis of the income statement data shown on the form below:

Definitions:

Fundamentalism

A strict adherence to specific theological doctrines typically in a reaction against modernist theories, often characterized by a literal interpretation of religious texts.

Pluralism

A political philosophy or system that recognizes and affirms diversity within a political body, allowing for the peaceful coexistence of different interests, convictions, and lifestyles.

Calvin Coolidge

The 30th President of the United States, serving from 1923 to 1929, known for his conservative policies and small government philosophy.

Reconstruction Finance Corporation

A federal agency established in 1932 under President Hoover to provide financial support to state and local governments and make loans to banks, railroads, and other businesses.

Q37: Which of the following sections from the

Q63: Which of the following would be included

Q72: The following information is from the balance

Q91: In a vertical analysis of the income

Q93: South State Company used $71,000 of direct

Q98: Which of the following pertains to a

Q122: Ace Plastics produces many different kinds of

Q133: Avatar Company uses the indirect method to

Q140: Partridge Company provides the following information for

Q153: Avatar Company uses the indirect method to