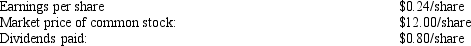

Partridge Company provides the following information for the year 2014:  (No preferred stock issued)

(No preferred stock issued)

How much was the dividend payout for one share of common stock?

Definitions:

Solutions

Homogeneous mixtures composed of two or more substances where one substance, the solute, is dissolved in another, the solvent.

Proton

A subatomic particle found in the nucleus of an atom, possessing a positive electrical charge.

Conjugate Acid

A chemical species formed by the reception of a proton (H+) by a base, often involved in acid-base reactions.

Q3: When direct materials are requisitioned, the Work

Q22: Bilkins Financial Advisors provides accounting and finance

Q37: Which of the following sections from the

Q59: Peartree Company provides the following data: <img

Q96: Avatar Company uses the indirect method to

Q112: Please refer to the following information for

Q116: Ross Corporation reported the following equity section

Q127: Most preferred stock is non-cumulative.

Q148: Free cash flow is the same thing

Q162: On June 30, 2013, Stephans Company showed