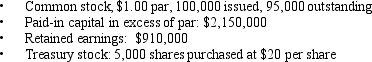

Please refer to the following information for Peartree Company:  If Peartree resold 1,000 shares of treasury stock for $24 per share, what journal entry would be required?

If Peartree resold 1,000 shares of treasury stock for $24 per share, what journal entry would be required?

Definitions:

Effective Tax Rate

The average percentage of net income that a person or corporation pays in taxes, effectively showing the portion of income gone to taxes.

Non-Controlling Interest

A minority share of ownership in a subsidiary that is not directly controlled by the parent company, typically reflected in the equity section of the consolidated financial statement.

Consolidated Financial Position

A representation of a parent company and its subsidiaries' financial status as one entity, summarizing assets, liabilities, and equity.

Acquisition Differential

The difference between the purchase price of a company and the fair value of its identifiable net assets at the acquisition date.

Q6: Normal expenditures for repairs and maintenance should

Q8: A 3-for-1 stock split will:<br>A)triple the par

Q21: Starfire Company uses the indirect method to

Q21: The following information is from the balance

Q25: Which of the following is NOT a

Q62: Which of the following is NOT a

Q91: On November 1, 2012, EZ Products borrowed

Q98: A disadvantage of the corporation is the

Q138: Hot Tamale Company had $120,000 of revenues

Q153: Preferred Products started business on March 1,