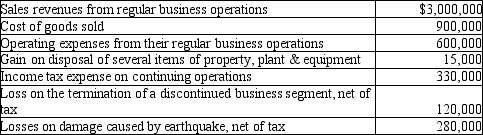

At January 1, 2014, Foxmore Company had 80,000 shares of common stock outstanding and no preferred stock. During the year, they issued 40,000 additional shares of common stock. At December 31, 2014, Foxmore had 120,000 shares of common stock outstanding, and no preferred stock. In addition, Foxmore reported the following results for the year 2014:  At December 31, 2014, how much is the earnings per share for total net income (loss) ?

At December 31, 2014, how much is the earnings per share for total net income (loss) ?

(Please round all calculations to the nearest cent.)

Definitions:

Incremental Analysis

The process of comparing the expected costs and benefits of alternative decisions, focusing on the differences between them.

Net Income

The profit of a company after all expenses, taxes, and costs have been subtracted from total revenue.

Unprofitable Segment

A division or part of a company that does not generate profit and may result in a financial loss for the company.

Cost of Capital

The required return necessary to make a capital budgeting project, such as building a new factory or investing in new equipment, worthwhile.

Q1: Paid-in capital consists of:<br>A)amounts paid by customers.<br>B)capital

Q8: Which would NOT be included in the

Q18: At January 1, 2014, Foxmore Company had

Q28: Peartree Company provides the following data: <img

Q35: Which of the following items is NOT

Q40: Notebook Company had the following transactions in

Q65: A company reported the following amounts of

Q75: Gordon Corporation reported the following equity section

Q95: Happy Holiday, Inc. has 100,000 shares of

Q104: Goodwill is amortized each year, similar to