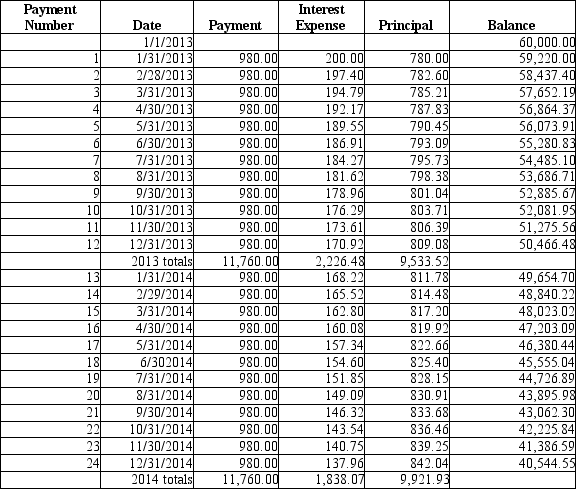

On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note for $60,000 at 4%. Please see the partial amortization schedule below.

On January 1, 2013, Thames recorded the entire principal amount of $60,000 as mortgage payable. They would then record a second entry to reclassify the current portion. Please provide that entry.

On January 1, 2013, Thames recorded the entire principal amount of $60,000 as mortgage payable. They would then record a second entry to reclassify the current portion. Please provide that entry.

Definitions:

Property Disposal

The act of getting rid of property, whether by sale, destruction, donation, or other means, especially in the context of public or corporate assets.

Making A Will

The legal process through which an individual specifies how their assets should be distributed after death.

Testator

A person who has made a will, especially one that is legally valid.

Incomplete Disposition

The failure to fully deal with or dispose of an asset or a legal matter.

Q6: Normal expenditures for repairs and maintenance should

Q61: Free cash flow is the measure of

Q70: A bond is sold for an amount

Q77: A corporation originally issued $8 par value

Q90: Which of the following is the expected

Q92: A corporation has 15,000 shares of 10%,

Q103: A mine is purchased for $4,000,000. There

Q108: Which of the following exists if the

Q145: Archer Company and Zorro Company both have

Q169: Which of the following items should NOT