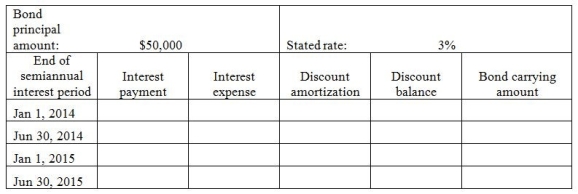

On January 1, 2014, Partridge Company issued $50,000 of 6-year bonds with a stated rate of 3%. The market rate at time of issue was 4%, so the bonds were discounted and sold for $47,331. Partridge uses the effective-interest rate of amortization for bond discount. Semiannual interest payments are made on June 30 and December 31 of each year. Please complete the amortization table for the first four interest payments.

Definitions:

Reserve Requirement

The lowest sum of money that a bank is required to keep as reserves against the deposits it holds, as mandated by the central bank.

Federal Funds Rate

The interest rate at which banks lend reserves to each other overnight, a key tool of monetary policy used by the Federal Reserve to influence the economy.

Buying Bonds

The act of purchasing debt securities issued by governments or corporations, which pay interest over a fixed period.

Money Supply

The aggregate sum of funds present in an economy at a given moment, encompassing cash, bank deposits, and various readily accessible assets.

Q29: Which of the following statements is TRUE?<br>A)Accounts

Q51: Accounts receivable has a balance of $16,000

Q63: If the difference between the effective-interest method

Q112: Occidental Produce Company has 40,000 shares of

Q119: An asset has a life of 3

Q136: Please refer to the equity section of

Q144: Ross Corporation reported the following equity section

Q145: The time value of money is based

Q160: A company's income tax expense is calculated

Q165: Navajo Mining Company purchased a mine in