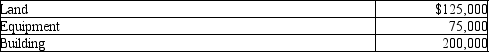

Hastings Company has purchased a group of assets for $350,000. The assets and their market values are listed as follows:  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

Definitions:

Mortgage Interest

The interest charged on a loan used to purchase a property, often tax-deductible for the borrower.

Depreciation

An accounting method that allocates the cost of a tangible asset over its useful life.

Cost Recovery

The method by which businesses deduct or amortize the cost of property over a period, for tax purposes, to recover the expense of capital investments.

Net Loss

Net loss occurs when a company's expenses exceed its revenues during a specific period, reflecting a decrease in net assets from operations and other activities.

Q23: In reconciling a bank statement, the bank

Q49: Paris Company buys a building on a

Q63: In the following situation, which internal control

Q71: Accelerated depreciation differs from straight-line depreciation in

Q82: Dallkin Corporation issued 5,000 shares of common

Q83: Which of the following should the purchasing

Q122: At the beginning of 2014, Mark's sales

Q137: Around the end of the year, an

Q153: Which of the following items is included

Q161: Paris Company buys a building on a