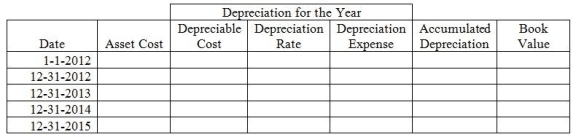

On January 1, 2012, a company buys a truck for $42,000 cash. It has estimated residual value of $2,000, and an estimated life of 4 years, or 200,000 miles. Assume the company uses units-of-production depreciation. The truck drove 40,000 miles in 2012, 60,000 miles in 2013, 80,000 miles in 2014, and 20,000 miles in 2015. Please complete the depreciation schedule below.

Definitions:

Q7: Which of the following is included in

Q21: At the beginning of 2014, Mark's sales

Q48: No gains or losses are ever recorded

Q61: The materiality concept requires that a company

Q75: McDonald Sales prepared a bond issue of

Q105: If a bond's stated interest rate is

Q118: Goodwill is NOT amortized-but evaluated-each year for

Q129: Tangible assets must be tested for impairment

Q136: A company that uses the perpetual inventory

Q141: Which of the following items is included