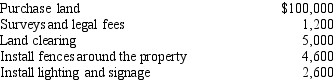

Acme Investments plans to develop a shopping center. In the first quarter, they spent the following amounts:  What amount should be recorded as the land cost?

What amount should be recorded as the land cost?

Definitions:

Married Person

A tax filing status for individuals who are legally married, affecting tax brackets, allowances, and potential deductions.

Tax Liability

The total amount of tax owed to a taxing authority, such as the IRS, based on taxable income and tax rate.

Personal and Dependency

Terms related to exemptions that can be claimed on tax returns for oneself and for dependents, affecting taxable income.

Exemption

Deductions allowed by law to reduce taxable income based on the taxpayer and dependents.

Q3: Which of the following items are both

Q13: The income statement approach computes uncollectible accounts

Q14: Overton Company had the following transactions in

Q18: Which of the following describes collusion?<br>A)When bogus

Q77: A corporation originally issued $8 par value

Q77: Lerner Company had the following transactions in

Q112: On November 1, 2015, Archangel Services issued

Q119: Which of the following factors may cause

Q148: Which of the following statements describes the

Q159: Which of the following statements describes an