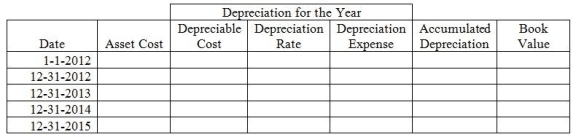

On January 1, 2012, a company buys a truck for $42,000 cash. It has estimated residual value of $2,000, and an estimated life of 4 years, or 200,000 miles. Assume the company uses units-of-production depreciation. The truck drove 40,000 miles in 2012, 60,000 miles in 2013, 80,000 miles in 2014, and 20,000 miles in 2015. Please complete the depreciation schedule below.

Definitions:

Vitamin K

A group of fat-soluble vitamins essential for the synthesis of proteins involved in blood coagulation and bone metabolism.

Prothrombin

A protein in blood plasma that is converted into active thrombin during coagulation.

Liver

A large, vital organ in vertebrates, involved in numerous metabolic processes including detoxification, protein synthesis, and the production of biochemicals necessary for digestion.

Fibrin

A protein involved in blood clotting, formed from fibrinogen during the clotting process to create a mesh that seals wounds.

Q7: Paying dividends causes a decrease in total

Q47: Blanding Company issues $1,000,000 of 8%, 10-year

Q60: Samson Company had the following balances and

Q61: A plant asset is fully depreciated when

Q85: Acme purchased a property that included both

Q100: Santa Fe Tile Company had the following

Q107: Tarheel Services is holding a note receivable

Q117: On January 1, 2013, Davie Services issued

Q148: Which of the following statements describes the

Q152: At the beginning of 2014, Mark's sales