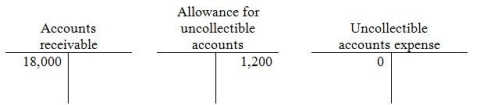

At January 1, Everbright Sales has the following balances:  During the year, Everbright has $150,000 of credit sales, collections of $140,000, and write-offs of $3,000. Everbright records Uncollectible account expense at the end of the year using the aging method. At the end of the year, the aging analysis produces a figure of $1,900, being the estimate of uncollectible accounts at end of year.

During the year, Everbright has $150,000 of credit sales, collections of $140,000, and write-offs of $3,000. Everbright records Uncollectible account expense at the end of the year using the aging method. At the end of the year, the aging analysis produces a figure of $1,900, being the estimate of uncollectible accounts at end of year.

Before the year-end entry to adjust the Uncollectible accounts expense is made, what is the balance in the Allowance for uncollectible accounts?

Definitions:

Workweek

The standard period of time during which work is typically performed, often defined as 40 hours across five days in many countries.

Equity Mutual Fund

A type of mutual fund that primarily invests in stocks, aiming to provide returns through dividends and capital gains.

Rate of Return

A measure of the gain or loss on an investment over a specified time period, expressed as a percentage of the investment's cost.

Holding Period

The duration of time an investment is held before being sold, which can affect the rate of return and tax implications.

Q1: The current portion of notes payable must

Q11: A company has purchased inventory and receives

Q12: On January 2, 2014, Mahoney Sales issued

Q48: Berring Sales uses the average-cost method. The

Q90: Accounts receivable has a balance of $5,000

Q112: What is the difference between a sales

Q122: Estimated ending inventory can be computed by

Q134: A company has Net sales of $1,700,000,

Q156: When a company uses the perpetual inventory

Q159: Ajax Company was founded in 2009. Its