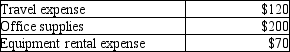

A petty cash fund was established with a $400 balance. It currently has cash of $10 and petty cash tickets as shown below.  The journal entry to replenish the account would be which of the following:

The journal entry to replenish the account would be which of the following:

Definitions:

Temporary Differences

Differences between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in the future.

Taxable Income

The amount of income used to calculate how much the entity owes in taxes to the federal, state, and/or local government.

Pretax Financial Income

The income of a company before taxes are deducted, often used in financial reporting and analysis.

Interperiod Tax Allocation

A method used in accounting to allocate income taxes over different periods to match taxes with the revenues they affect.

Q39: The consistency principle states that businesses should

Q43: The following pertains to periodic inventory: Compute

Q44: Reid Art Supply Company uses a perpetual

Q47: Corey Sales sold its old office furniture

Q88: An acid-test ratio of at least 1.0

Q110: Which of the following is NOT a

Q115: An asset was purchased for $12,000. The

Q123: Which of the following costs related to

Q131: For strong controls over cash receipts, the

Q140: A patent is an exclusive right to