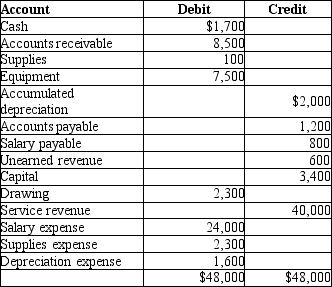

The following is the adjusted trial balance for Tuttle Photography.

Using the information from the worksheet above, prepare the closing entry for Revenues.

Using the information from the worksheet above, prepare the closing entry for Revenues.

Definitions:

Selling Expenses

Expenses incurred directly or indirectly in making a sale, such as commissions, advertising costs, and shipping expenses.

Disallowed Loss

A loss that cannot be claimed for tax deduction purposes because it does not meet certain IRS criteria.

Capital Gains

The profit from the sale of assets or investments when the selling price exceeds the original purchase price.

Adjusted Gross Income

An individual's total gross income minus specific deductions. It's used as the basis for calculating taxable income.

Q25: The balance of an account is the:<br>A)amount

Q27: Under which of the following inventory costing

Q29: In a previous month, the business purchased

Q38: Managerial accounting focuses on information for decision

Q45: FOB shipping point means that the:<br>A)seller normally

Q57: In an LLC, the business, not the

Q85: For Capital, the category of account and

Q103: An entry that reflects the using up

Q120: A company uses perpetual inventory in connection

Q144: Sales revenues were $20,000, Sales returns and