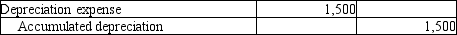

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following is the entry which was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

Definitions:

1933 Act

The Securities Act of 1933, a U.S. law aimed at ensuring more transparency in financial statements so investors can make informed decisions about securities investments.

Regulatory Components

Elements or aspects of laws, regulations, or guidelines that impact how businesses and individuals must conduct themselves.

Registration Provisions

Legal requirements for the recording or listing of an item, transaction, or entity with a designated authority to make it legally recognizable and/or to regulate it.

Rule 163

Without a specific context, this refers to a regulatory or procedural guideline within a particular legal, financial, or institutional framework that may differ significantly in content across contexts.

Q13: What type of account is Unearned revenue

Q18: Hamilton Lawn Service incurred $800 repair expense

Q57: In an LLC, the business, not the

Q83: The following transactions have been journalized and

Q116: Sales revenues were $20,000, Sales returns and

Q117: Caleb Brown has been the sole owner

Q134: The Sarbanes-Oxley Act ("SOX")made it a criminal

Q137: Which of the following accounts increases with

Q143: Avery Supplies uses a periodic inventory system.

Q144: Sales revenues were $20,000, Sales returns and