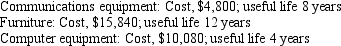

Hank's Tax Planning Service has the following plant assets:

Hank's monthly depreciation expense is:

Hank's monthly depreciation expense is:

A)$2,560.

B)$4,440.

C)$210.

D)$370.

Definitions:

Profitability Index

A fiscal indicator that evaluates an investment's comparative profitability by calculating the ratio of the present value of future cash inflows to the upfront cost of the investment.

Present Value

The immediate worth of a future financial amount or sequences of cash flows, using a specified rate of return for calculation.

Invested Costs

Costs that have already been incurred for a project or investment.

Discount Rate

The interest rate used to discount future cash flows to their present value, commonly used in capital budgeting and investment planning.

Q7: Unearned revenue would be classified as a(n)_

Q28: The process of copying from the journal

Q51: A business hired a repairman to overhaul

Q73: Which of the following is TRUE about

Q98: Which of the following journal entries would

Q109: Which of the following is subtracted from

Q118: A journal entry for a $75 payment

Q128: Hank's Tax Planning Service bought communications equipment

Q135: Which of the following entries would be

Q135: The following transactions have been journalized and